Our commitment

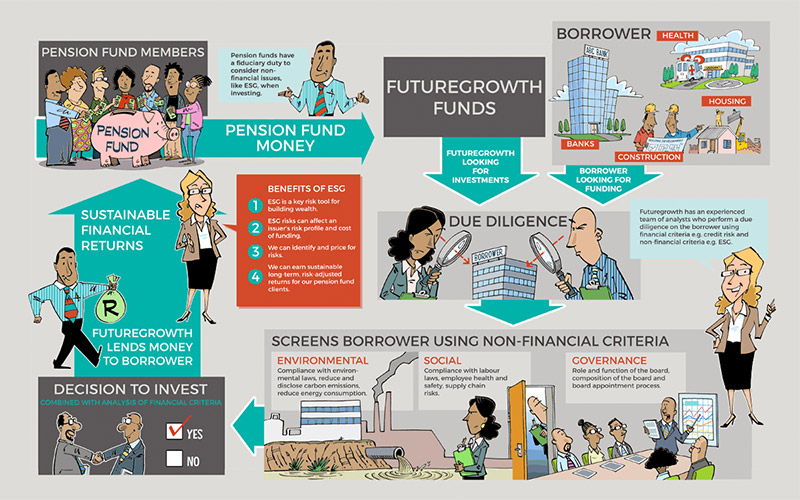

The purpose of integrating ESG factors into the investment process is to improve the analysis of all investments, promote improving standards of practice, and assist the investment process to mitigate any ESG risks to potential or existing loans or investments.

The application of ESG analysis and screening is defined by our clients’ expressed preferences. Where no preference is expressed, we exercise judgement and integrate ESG issues into the investment analysis and decision-making process with the view of mitigating overall portfolio risk. At all times the fund’s asset allocation or investment strategy must prevail to ensure that risk-adjusted returns are achieved. Principles of sound portfolio management should not be compromised in the RI or ESG screening process.

Futuregrowth endorses the Code for Responsible Investment in South Africa (CRISA) and is a signatory to the Principles for Responsible Investment (PRI).

Crisa annual disclosure statement

PRI annual disclosure statement

Our approach to climate risk

In accord with the requirements of regulation 28 and our fiduciary responsibility, Futuregrowth seeks to assess all risks, including ESG (climate-related) risks, as part of our fundamental investment process, and to integrate such considerations into a risk:return framework. Further, we have chosen to have a position on climate risk which incorporates our belief that global warming is a real factor affecting investments (risks and returns) and the sustainability of the country (and the world) for all citizens. Thus, our Responsible Investment (RI) philosophy includes the goal of reducing carbon-emitting investments.

As a PRI signatory, we are aware of the mandatory PRI reporting requirements of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD), we are committed to report on the TCFD principles as part of our overall RI strategy.

our responsible investment strategy

We apply ESG screening, proxy voting, and active ownership and engagement as key components of our responsible investment strategy. An output of this process is our range of developmental investments.

"Consciously seeking to invest client funds in a responsible manner."