The Futuregrowth story:

Past and future

Futuregrowth was founded in 1994 in the wake of South Africa’s democratic transition, with a small suite of investment funds focused on social development and empowerment, and with the vision of creating a sustainable channel for pension funds to invest in disadvantaged communities and national development.

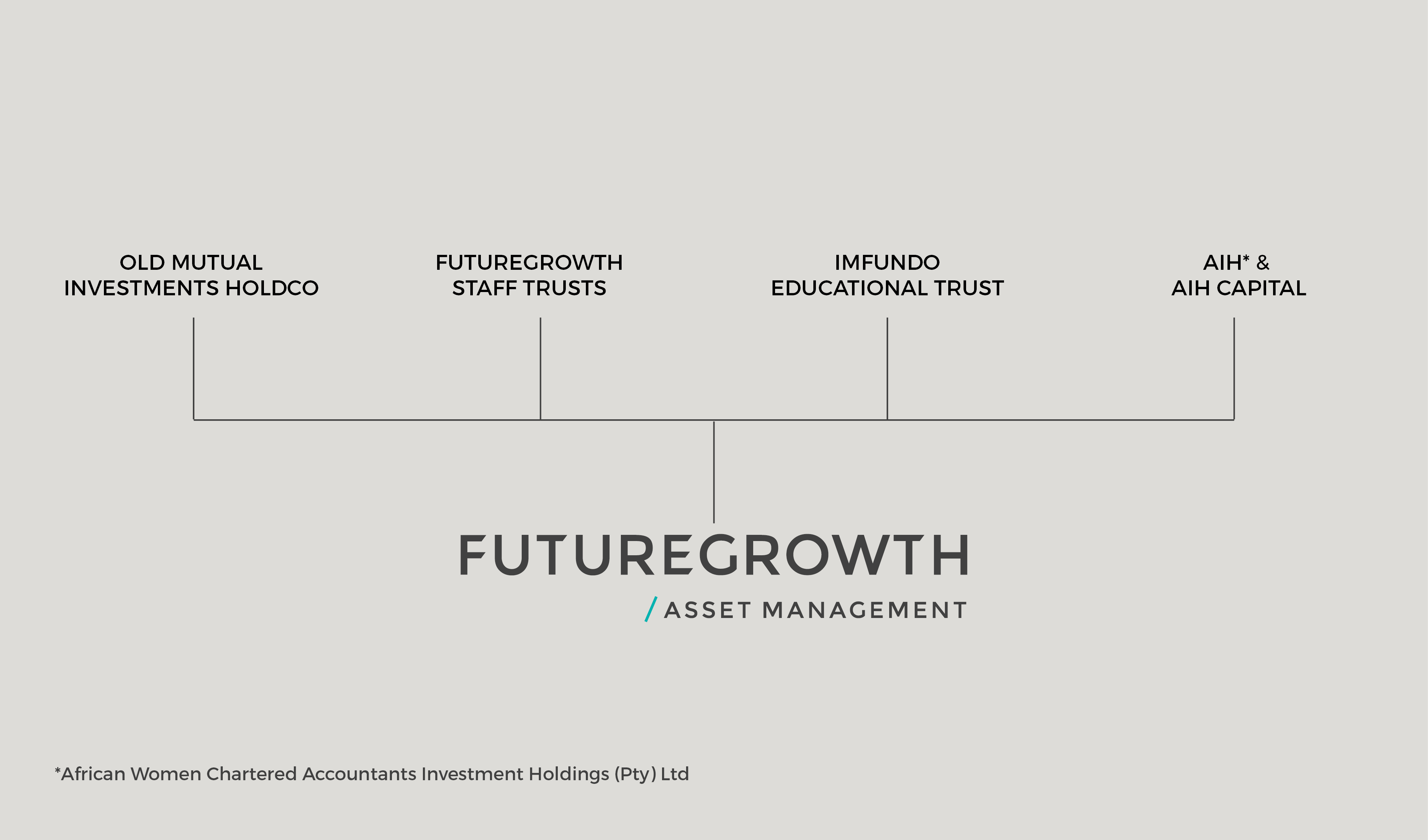

Futuregrowth’s empowerment partnerships

From 2002 to 2008 Futuregrowth had an empowerment shareholder in Women’s Investment Portfolio Holdings (Wiphold), a women-owned black empowerment fund. Wiphold acquired 40% of Futuregrowth in 2002, and in 2005 increased its holding to 70%, further cementing Futuregrowth as the largest Black-owned fund manager in South Africa. Since the exit of Wiphold with their sale to Old Mutual in 2008, we had had a strategic objective to reattain greater than 50% effective black share ownership – and to find a shareholder and empowerment partner with a similar sense of purpose and shared values. This was found in African Women Chartered Accountants Investment Holdings (Pty) Ltd (AIH). AIH is a wholly black women-owned investment company that supports the entry and advancement of black woman in the chartered accountancy profession and beyond. On 3 March 2022 we announced the acquisition of 21.2% of Futuregrowth shares by a special purpose vehicle owned by AIH and AIH Capital (Pty) Ltd. All conditions precedent have been met, and Futuregrowth now has a 52.2% black share ownership.

Read: Futuregrowth gains substantial black shareholder

Making a bigger difference to our industry and people’s lives

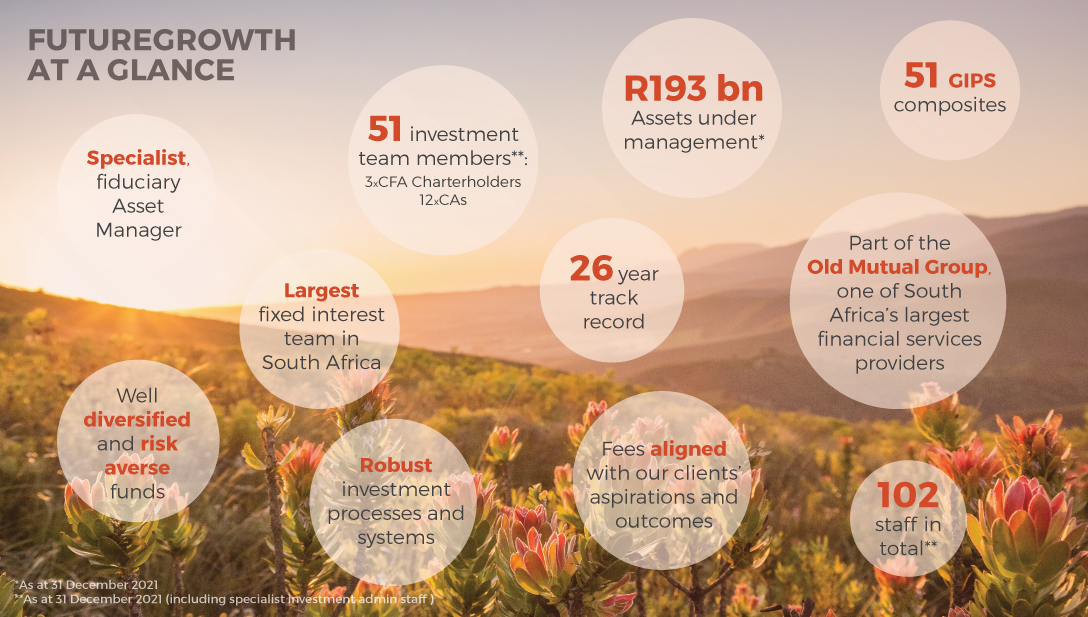

Today, Futuregrowth manages around R193 billion (US$12 billion)* of clients’ assets - across the full range of fixed interest and development funds - and plays a leadership role in the asset management industry in South Africa. During this time, we have not wavered from our purpose: to protect and grow investors’ savings through skill and diligence, while being a force for good in the markets and environment in which we operate.

This sense of purpose is based on our belief that investors can make a positive difference in society while earning sound investment performance for pension fund members. That has inspired us to pioneer development funds in sectors such as infrastructure, rural and township retail property, agriculture and renewable energy, providing finance to innovative deals - including low-income housing construction, a church in Soweto, urban regeneration projects, taxi finance, tech start-ups and alternative energy, to name a few.

As a responsible investor we engage with our industry and investee companies privately, and sometimes publicly, on sustainability issues. As examples: we have been working steadfastly to improve South Africa’s debt capital market standards for over a decade. In 2013, we identified unfair, unsustainable and prejudicial practices within the consumer lending industry and we chose to stop lending to such businesses in our developmental funds - and publicly called for industry reform. And in 2016, we announced that we could no longer in good conscience invest pension fund members’ assets in certain State-Owned Enterprises (SOEs) until we had concluded detailed governance reviews. Recently, we have hosted or participated in webinars on corporate governance, investor activism, reform of the energy sector, the ailing fiscal position, whistleblowing and several other pertinent topics.

The original concept of Futuregrowth is still alive and thriving in the Futuregrowth of today. Even though the company has developed into a successful asset management business, the philosophical belief on which the business was founded back in 1994 is still at the core of everything we do.

*AUM as at 31 December 2022

Our promise to clients

At Futuregrowth we take our ethical responsibility towards our clients seriously. These nine statements make up our promise to you.

- Our clients’ interests always come first.

- We apply investment judgment based on informed, diligent, objective, and independent analysis.

- Our behaviour is honest, competent, ethical, and complies with applicable laws and regulations.

- We treat all clients fairly.

- We avoid conflicts of interest in the provision of our products and services, but where unavoidable make full disclosure to clients.

- Client confidentiality is upheld at all times.

- Our costs are fair, reasonable, and transparent and are clearly explained.

- We communicate clearly, accurately, and in a timely and effective manner.

- We keep appropriate and complete client records.

If your experience of Futuregrowth is not aligned with these statements please let us know at ourpromise@futuregrowth.co.za.

Note: This promise statement is adapted from the CFA Institute’s Statement of Investor Rights. Click here to view these Rights.