Transformation is not something you do because you are told to, but something that you live and practice because it is the right thing to do.

Success is a journey

Futuregrowth’s transformation journey started long before this was legislated by the Financial Sector Charter.

- In the early 2000s our approach was to hire young previously disadvantaged graduates with limited or no work experience and exposed them to our business, from the bottom up.

- In 2009, when Old Mutual Investment Group (OMIG) became Futuregrowth’s main shareholder, we continued on this path by tapping into the OMIG Graduate Accelerated Programme (GAP).

- During 2010, we conducted our first set of interviews. Our first GAP candidate, Yunus January, started his employment with Futuregrowth in January 2011.

- To date, all our GAP candidates have been offered permanent employment at Futuregrowth after completion of their internships.

- In our environment, it is possible for the GAP employees to become fully-fledged investment professionals in the investment team if they actively pursue this.

//THE TAKEOUT

It is possible for inexperienced previously disadvantaged (PDI) graduates to become self-sufficient investment professionals through our transformation process.

Minding the GAP

GAP candidates in the investment team are typically placed in the Specialist Investment Administration (SIA) area, where they are given a specific role for their internship period. Here, their responsibilities and decision making start on day one. They have access to the entire investment team for guidance and are invited to participate in the team’s investment process if they have the capacity and interest to do so.

Investment analysts from the GAP programme

//THE TAKEOUT

GAP appointees can find a meaningful role anywhere along the investment chain.

An equal voice

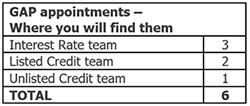

Formal investment decisions at Futuregrowth are made within five separate forums:

- The Interest Rate Team - makes all interest rate decisions;

- The Listed Credit Committee - approves all listed/market credit trades;

- The Unlisted Credit Committee - approves all unlisted/off-market credit trades;

- The Investment Committee - approves all equity trades; and

- The Dealing desk – has deal execution rights and also makes all the money market investment decisions.

We typically follow a team-based approach to investment decision making, with quorum requirements stipulating that experienced members of the team are present at decision points. Apart from the quorum obligations, there is no hierarchy within the investment decision forums.

This means that young PDI investment professionals have an equal voice/vote in investment decision making, regardless of their title.

//THE TAKEOUT

All investment team members are invited to have a say in investment decisions.

Tackling the challenge head on

While we did very well in introducing young PDI candidates to the business and transitioning them into the investment team, we still had a significant lack of transformation at the senior decision making level - particularly among the Portfolio Managers. Historically, Portfolio Managers in the industry were white males and the same was true at Futuregrowth in the past.

We decided to tackle this challenge head on in 2016, when the Portfolio Manager (PM) Training Programme was born. At the time, there was no clear process for members of the investment team to become Portfolio Managers. Added to this, some of the existing Portfolio Managers were getting on in years and we also had too many portfolios relative to the number of portfolio managers - leading to excess workload. This implied a business continuity risk.

//THE TAKEOUT

The PM Training Programme has been put in place to fast-track transformation at the Portfolio Manager level.

PM Training Programme Candidates

Expanding the range of leadership roles

Historically, the Portfolio Manager was seen as the senior investment professional within the investment team. However, appointing some individuals to the role of Portfolio Manager took them away from their area of expertise. We therefore reviewed our organisational structure to allow for specialisation, career growth and seniority – in roles within the investment team with titles other than Portfolio Manager. These include:

- Head of Listed Credit (PDI female);

- Co-head of Unlisted Credit (PDI male);

- Head of Unlisted Equity Transactions (PDI male);

- Head of the Credit and Equity process (white female); and

- Head of Risk Management (PDI female).

//THE TAKEOUT

We have introduced a diversity of senior roles within the investment team.

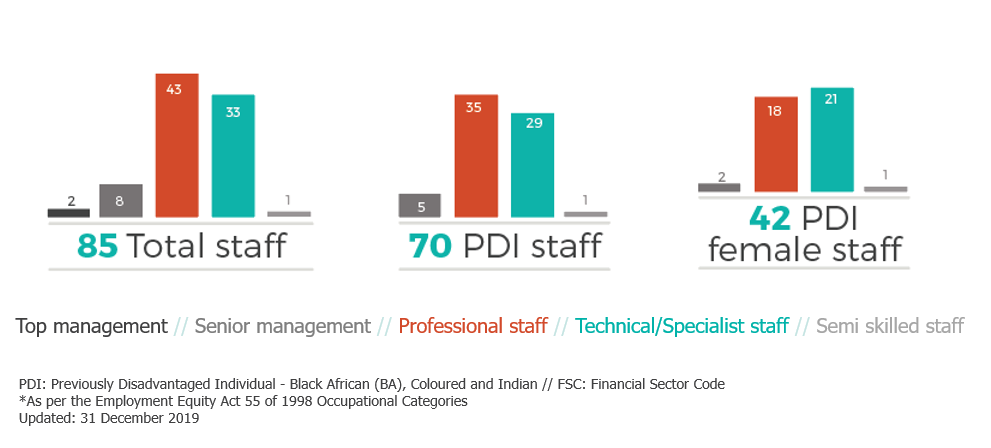

Gender diversity

Women currently account for 45% of our investment team, which is relatively high for our industry. Research has shown that female analysts are likely to be more skillful than men. However, when hiring, our aim is to find the best candidate for the role, regardless of gender – with preference given to PDI candidates where possible.

Some of the most senior roles in the investment team are held by women

The picture below includes three Portfolio Managers (including one who is Head of Risk Management), three Portfolio Management trainees (including one who is Head of Listed Credit) and the Head of Credit and Equity.

//THE TAKEOUT

Gender research informs, but does not dictate, our hiring decisions.

Who manages your fund?

At Futuregrowth, we want to do the right things for the right reasons. Transformation benefits us all – and without it we limit our vast potential. Historically, we have focused on approaching transformation from the bottom up. More recently, however, we have realised that we need to do more to improve our key investment decision-making complement. We are also actively reviewing our shareholding - with the aim of becoming a majority black-owned business as soon as we feasibly can.

Get the PDF version Transformation in the investment process – the right thing to do.